We collaborate to achieve sustainable success

A leading environmental solution provider

Get in touch with usUnderstanding Volatility: Price Dynamics in U.S. REC and RIN Markets (2024-2025)

The U.S. environmental commodity markets, while offering significant opportunities for decarbonization and economic growth, are characterized by inherent price volatility. For market participants, particularly financial and trading firms, a nuanced understanding of these dynamics is paramount for effective risk management and strategic decision-making. This article delves into the specific factors contributing to price fluctuations in Renewable Energy Certificates (RECs) and Renewable Identification Numbers (RINs), offering insights into navigating these complex and evolving markets.

Renewable Energy Certificates (RECs): Navigating the Green Power Landscape

Renewable Energy Certificates (RECs) are market-based instruments that verify the generation of one megawatt-hour (MWh) of electricity from a renewable source and its delivery to the power grid. They serve as the official mechanism for tracking and claiming renewable energy usage, enabling businesses to credibly reduce their reported Scope 2 emissions (indirect emissions from purchased electricity) and meet sustainability commitments like net-zero goals.

The REC market operates across two primary segments:

- Compliance RECs: Used by utilities and regulated entities to fulfill state Renewable Portfolio Standards (RPS).

- Voluntary RECs: Purchased by corporations and individuals to meet self-imposed sustainability objectives, with Green-e® Energy certification playing a crucial role in ensuring market integrity. The voluntary REC market is currently experiencing substantial growth, indicating a rising demand for verifiable renewable energy solutions.

Factors Influencing REC Price Volatility

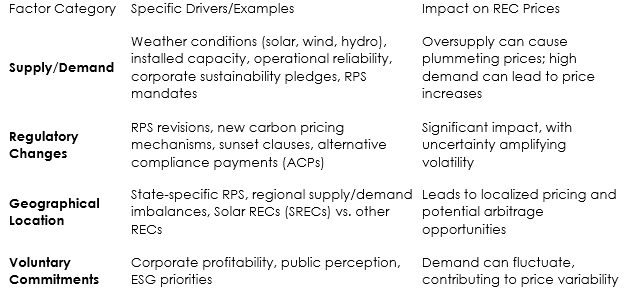

REC prices exhibit volatility influenced by market dynamics, regulatory shifts, and geographical considerations:

- Supply and Demand: Supply is shaped by weather conditions affecting solar, wind, and hydro generation, total installed renewable capacity, and operational reliability. Oversupply can lead to price declines, while strong demand (driven by corporate pledges and RPS) typically results in price increases.

- Regulatory Changes: Revisions to RPS mandates, introduction of new carbon pricing mechanisms, or expiration of incentives (sunset clauses) can profoundly impact prices. Regulatory uncertainty, in particular, tends to amplify market volatility. The use of "alternative compliance payments" (ACPs) can also cap REC prices, potentially discouraging new investment.

- Geographical Location and Regional Disparities: RECs are generally valid only within specific regions or states, leading to localized supply-and-demand imbalances and distinct pricing structures. States with more ambitious RPS targets often experience higher REC prices. While REC arbitrage exists to capitalize on price differences, transaction costs and regulatory hurdles can impede its full effectiveness. Solar RECs (SRECs) often command a premium due to specific mandates or perceived environmental benefits.

- Voluntary Commitments: While a significant demand driver, corporate voluntary commitments can fluctuate based on profitability, public perception, and evolving Environmental, Social, and Governance (ESG) priorities, further contributing to price variability.

The dynamic interaction between compliance and voluntary REC segments provides a crucial stabilizing force. When compliance-driven demand wanes or prices decline, voluntary buyers often step in, seeking to acquire RECs at attractive price points for their sustainability objectives. This strategic absorption of excess supply helps mitigate extreme downward price movements, contributing to a more resilient market structure. The upward sloping futures curve observed for Green-e certified RECs further supports this positive long-term market sentiment.

The Inflation Reduction Act (IRA), while not directly regulating RECs, exerts a substantial indirect influence. The IRA has catalyzed unprecedented growth in clean energy development through transferable tax credits, increasing the overall supply of RECs. Concurrently, the IRA allows corporations to reinvest tax savings from these credits into other sustainability initiatives, including the procurement of unbundled RECs, effectively boosting demand. This dual effect of boosting both supply and demand provides a more robust foundation for the REC market, contributing to fundamental stability and growth potential.

The following table summarizes the key factors influencing REC market price volatility:

Renewable Identification Numbers (RINs): The Fuel of Federal Compliance

Renewable Identification Numbers (RINs) serve as the "currency of compliance" within the federal Renewable Fuel Standard (RFS) program. The RFS mandates specific volumes of renewable fuel to replace or reduce fossil fuel usage in transportation fuel, home heating oil, or jet fuel. Obligated parties, primarily fuel refiners, blenders, and importers, are required to obtain and retire a sufficient number of RINs to meet their Renewable Volume Obligation (RVO) for each specific renewable fuel category.

RINs are typically generated when a producer manufactures a gallon of renewable fuel, with each RIN representing an ethanol-equivalent gallon. A unique "D-code" is assigned to each fuel type (e.g., D3 for cellulosic biofuel, D4 for biomass-based diesel, D5 for advanced biofuel, D6 for conventional biofuel). Once the fuel is blended with petroleum-based fuel, the RINs can be separated and traded independently on the open market, allowing obligated parties to buy or sell RINs to fulfill their RFS obligations.

Factors Driving RIN Price Volatility

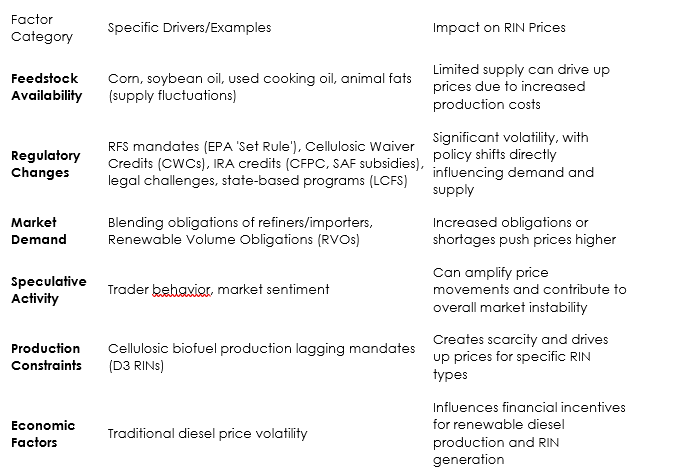

RIN prices are known for their significant volatility, influenced by a complex interplay of factors:

- Feedstock Availability: Fluctuations in the supply of key feedstocks, such as corn, soybean oil, used cooking oil, and animal fats, directly impact biofuel production costs and, consequently, RIN prices.

- Regulatory Changes: Updates to RFS mandates, rulings by the Environmental Protection Agency (EPA) (e.g., the 'Set Rule' for 2023-2025 which established lower-than-expected volumes for advanced biofuels), and broader policy shifts introduce considerable volatility. The elimination of Cellulosic Waiver Credits (CWCs) in the 'Set Rule', for example, removed a de facto price ceiling for D3 RINs, contributing to price surges. Legal challenges to EPA rules and the influence of state-based programs also affect RIN markets.

- Market Demand: The demand for RINs is primarily driven by the blending obligations imposed on refiners and importers. An increase in blending obligations or a shortage of available RINs typically pushes prices higher.

- Speculative Activity: Speculative trading contributes significantly to RIN price volatility. Traders actively buy and sell RINs with the aim of profiting from price fluctuations, and their collective actions can impact overall market stability.

- Supply Constraints (D3 RINs): Production of cellulosic biofuel (D3 RINs) has consistently lagged behind mandated levels, resulting in a limited supply and elevated prices. This forces obligated parties to compete for a small pool of available credits.

- Economic Factors: The volatility of traditional diesel prices can influence the financial incentives for producing renewable diesel, which in turn affects RIN generation.

The historical "blendwall" phenomenon, where ethanol blending mandates outpaced gasoline demand, leading to a surge in D6 RIN prices in 2013, illustrates the inherent tension between ambitious regulatory mandates and the practical realities of biofuel production and infrastructure. The ongoing challenges in cellulosic biofuel production (D3 RINs), where production consistently struggles to keep pace with aggressive growth targets, suggests a potential for similar supply-demand imbalances to persist, particularly for advanced biofuels. This structural dynamic implies that RIN markets, especially for D3 RINs, will likely continue to be characterized by periods of extreme price volatility.

The Inflation Reduction Act (IRA) introduces a new layer of complexity and potential volatility to the RIN market. The IRA provides new credits, such as the Clean Fuels Production Credit (CFPC), and increased subsidies for Sustainable Aviation Fuel (SAF) and carbon capture and storage (CCS), which are intended to stimulate the broader renewable fuels market. This direct financial incentive for biofuel production could lead to an increase in the potential supply of RINs. However, the IRA also introduces new crediting mechanisms that might either compete with or alter the demand for traditional RINs, or simply add another layer of regulatory complexity.

The following table summarizes the key factors influencing RIN market price volatility:

The price dynamics of U.S. REC and RIN markets are shaped by a complex interplay of supply, demand, regulatory policy, and broader economic factors. For AFS Commodities and other market participants, understanding these specific drivers of volatility is essential for developing robust risk management strategies, identifying arbitrage opportunities, and making informed trading and investment decisions. As these markets continue to mature and evolve, continuous market intelligence and adaptable strategies will be key to navigating their inherent complexities and capitalizing on the opportunities they present.